The Psychology Behind Buy Now, Pay Later (BNPL) Marketing

Introduction: The Rise of Psychological Financing

The Buy Now, Pay Later (BNPL) revolution has dramatically transformed the retail landscape, with global transaction volumes surging from $89 billion in 2020 to an estimated $433 billion by 2025 according to Kearney research. Yet the true innovation behind BNPL isn't the financing mechanism itself—installment plans have existed for decades—but rather the sophisticated psychological architecture that makes these services uniquely compelling to modern consumers. BNPL represents a masterful convergence of behavioral economics, digital user experience, and evolving consumer financial attitudes.

As behavioral economist Dan Ariely notes, "BNPL isn't just about financial convenience; it's about reimagining the psychological contract between consumers and their purchases." This psychological reframing has fueled adoption across demographic segments, with particularly strong resonance among Millennials and Gen Z consumers. Research from McKinsey reveals that 75% of BNPL users prefer it to credit cards, indicating a profound shift in how consumers conceptualize purchasing decisions.

This article examines the psychological mechanisms that power BNPL's rapid growth, the evolving marketing strategies that leverage these principles, and the implications for brands in an increasingly frictionless commerce ecosystem.

1. Temporal Discounting and Present Bias

The foundational psychological principle behind BNPL's appeal is temporal discounting—humans' tendency to value immediate rewards more highly than future ones. This cognitive bias, extensively documented by Nobel laureate Richard Thaler, explains why "Buy Now" becomes more attractive when the "Pay" component is pushed into the future.

- Reduced Pain Points: BNPL services strategically disaggregate the "pain of paying" that behavioral economists like Drazen Prelec identify as a significant purchase deterrent.

- Hyperbolic Discounting: Consumers disproportionately undervalue future payments, perceiving four payments of $25 as "less expensive" than a single $100 payment, despite identical amounts.

- Consumption Utility Acceleration: BNPL allows consumers to derive immediate utility from purchases while deferring the negative utility of payment.

Example: Afterpay's marketing explicitly leverages these principles with their tagline "Enjoy Now, Pay Later" and prominently displaying the first installment amount rather than the total cost. Their user interface further minimizes payment salience, resulting in a 20-30% increase in average order values according to merchant data.

2. Choice Architecture and Decision Framing

BNPL providers and their merchant partners excel at strategic choice architecture—the deliberate design of decision environments to influence behavior.

- Placement Optimization: BNPL options typically appear at critical conversion moments, serving as both payment facilitator and psychological "nudge."

- Default Bias Exploitation: By presenting BNPL as a standard payment option rather than a financing arrangement, providers normalize its use.

- Loss Aversion Triggers: Messaging often frames BNPL as a way to "avoid missing out" on desired products, activating loss aversion biases identified by Kahneman and Tversky.

Example: Klarna's integration into e-commerce platforms demonstrates sophisticated choice architecture. Their A/B testing shows that displaying BNPL options on product pages rather than just at checkout increases conversion by up to 40%, as consumers incorporate financing into their initial purchase decision rather than treating it as an afterthought.

3. Cognitive Simplification and Mental Accounting

BNPL services excel at reducing cognitive friction and leveraging mental accounting principles—the way consumers categorize and evaluate financial activities differently.

- Budgetary Partitioning: By dividing large purchases into smaller payments, BNPL helps consumers mentally assign costs to different "accounts" or time periods.

- Computational Simplification: Fixed installment amounts eliminate the complex interest calculations associated with traditional credit, reducing cognitive load.

- Discretized Consumption Tracking: Regular payments create a sense of controlled consumption rather than impulsive spending.

Professor Richard Thaler's mental accounting theory explains why consumers may simultaneously carry high-interest credit card debt while using BNPL for new purchases—they're perceived as separate financial activities despite mathematical irrationality.

Example: Affirm's transparent pricing model with clearly displayed payment amounts allows consumers to mentally budget purchases across pay periods. Their consumer research indicates that 67% of users say Affirm helps them better manage their finances, highlighting how simplification can change both behavior and perception.

4. Digital Identity and Consumption Signaling

BNPL services have successfully positioned themselves as lifestyle brands rather than financial products, tapping into consumers' desire for identity expression through consumption patterns.

- Status Accessibility: BNPL democratizes access to aspirational brands and products, allowing consumers to signal desired identities.

- Value-Aligned Consumption: Many BNPL providers emphasize transparent pricing and consumer-friendly terms, allowing users to signal financial sophistication.

- Generational Differentiation: Rejection of traditional credit aligns with younger generations' financial attitudes shaped by experiencing economic crises.

Research from cultural anthropologist Grant McCracken demonstrates how consumption increasingly serves identity formation functions in digital contexts—BNPL facilitates this by removing financial barriers to identity-signaling purchases.

Example: Swedish fintech Klarna's marketing campaigns feature celebrity partnerships and fashion-forward aesthetics that position BNPL as a lifestyle choice rather than a financial necessity. Their app's shopping discovery features further reinforce this identity-centric approach, resulting in 8x higher engagement than traditional banking apps.

5. AI-Powered Personalization and Behavioral Targeting

The latest evolution in BNPL marketing leverages artificial intelligence to create hyper-personalized experiences that anticipate consumer needs and preferences.

- Behavioral Prediction Models: AI analyzes purchase patterns to identify when consumers are most receptive to BNPL offerings.

- Dynamic Price Thresholds: Machine learning determines the optimal purchase amount at which to present BNPL options for individual users.

- Cross-Contextual Targeting: Predictive algorithms identify consumers across devices and platforms at moments of high purchase intent.

Marketing strategist Scott Brinker notes that "BNPL providers aren't just facilitating transactions; they're creating intelligence layers that reshape the entire commerce ecosystem."

Example: PayPal's BNPL solution uses AI to personalize which customers see "Pay in 4" options and when, based on purchase history, account health, and behavioral signals. This targeted approach has increased merchant conversion rates by up to 26% compared to generic BNPL presentation.

Conclusion: Beyond Financing to Psychological Commerce

BNPL represents more than a payment innovation—it's a sophisticated application of behavioral psychology to digital commerce. By addressing fundamental psychological barriers to purchase, BNPL providers have created an entirely new paradigm that bridges the gap between consumer desire and financial constraints.

As these services evolve, we're witnessing the emergence of what might be termed "psychological commerce"—transaction systems designed around cognitive patterns rather than traditional financial considerations. For forward-thinking brands, understanding the psychological mechanisms behind BNPL isn't just about offering another payment option; it's about fundamentally reconceptualizing the relationship between consumers, products, and the act of purchasing.

As consumer financial behaviors continue to evolve in response to economic pressures and technological innovations, the psychological principles underlying BNPL will likely influence far more than just payment methods—they may ultimately reshape how we think about consumption itself.

Call to Action

For marketing leaders looking to leverage the psychological insights of BNPL:

- Conduct consumer journey mapping that specifically identifies psychological friction points where BNPL integration could reduce purchase hesitation.

- Invest in advanced analytics that measure not just conversion impact but also how BNPL affects long-term customer value and purchasing patterns.

- Develop messaging frameworks that address both functional benefits and emotional payoffs of BNPL, tailored to your brand's specific customer segments.

Organizations that understand BNPL as a psychological tool rather than merely a financial offering will be best positioned to create meaningful consumer connections in an increasingly complex purchasing landscape.

Featured Blogs

TRENDS 2024: Decoding India’s Zeitgeist: Key Themes, Implications & Future Outlook

How to better quantify attention in TV and Print in India

AI in media agencies: Transforming data into actionable insights for strategic growth

How the Attention Recession Is Changing Marketing

The New Luxury Why Consumers Now Value Scarcity Over Status

The Psychology Behind Buy Now Pay later

The Rise of Dark Social and Its Impact on Marketing Measurement

The Role of Dark Patterns in Digital Marketing and Ethical Concerns

The Future of Retail Media Networks and What Marketers Should Know

Recent Blogs

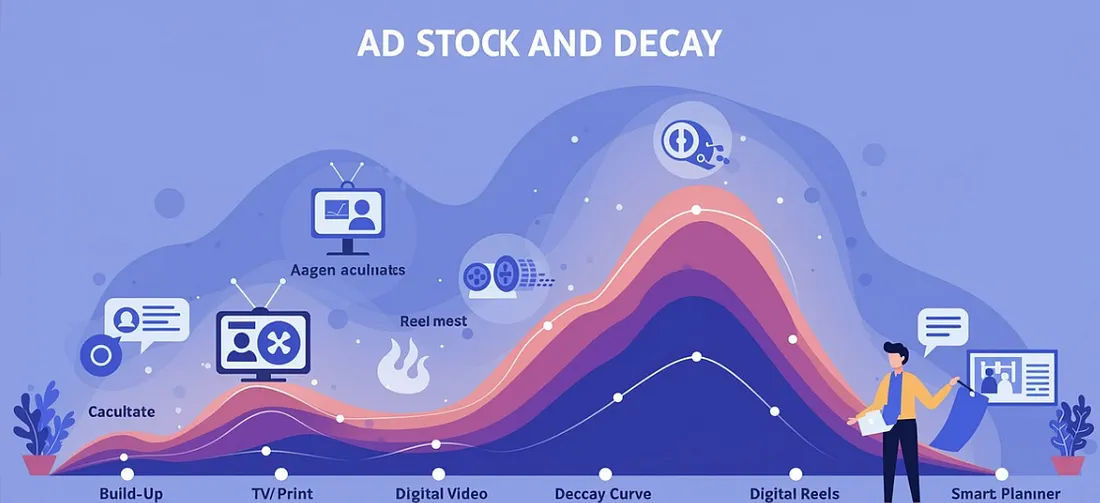

Ad Stock & Decay: The Invisible Hand Guiding Media Schedules

The Big Mac Illusion:What a Burger Tells Us About Global Economics

When Search Starts Thinking How AI Is Rewriting the Discovery Journey

CEP Tracker The Modern Brand Health Metric

Cracking Growth: How to Leverage Category Entry Points (CEPs) for Brand Advantage