GLP-1 Revolution : Reshaping CPG Food Industry Marketing

The rise of GLP-1 medications is reshaping the consumer packaged goods (CPG) food industry, as these appetite-suppressing drugs alter eating habits and food preferences. This shift is prompting CPG companies to adapt their strategies and product offerings to cater to a growing market of consumers using medications like Ozempic, Wegovy, and Mounjaro.

Impact on Consumer Behavior

GLP-1 medications are significantly influencing consumer purchasing patterns:

- Reduced Spending: Users of GLP-1 drugs spend an average of 11% less on most food categories, with the largest reductions in sweet and salty snacks and baked goods.

- Healthier Choices: 56% of GLP-1 users report making healthier food choices, while 47% say they eat smaller portions.

- Calorie Reduction: GLP-1 users typically reduce their calorie intake by 20% to 30% daily.

- Shift in Preferences: There's increased demand for foods lower in sugar, carbohydrates, and calories, yet still satisfying and flavorful.

Changes in CPG Food Categories

The impact of GLP-1 medications varies across different CPG food sectors:

- Negative Impact: Frozen, refrigerated, general food, and beverages are the most negatively affected categories.

- Positive Impact: Produce and deli departments are seeing increased sales as users seek more vegetables, fruits, and protein.

- Mixed Results: Salty snacks are experiencing a slight decline, but weren't among the top products with reduced spending.

Adaptation Strategies for CPG Companies

To address these changing consumer habits, CPG companies are implementing various strategies:

- Product Innovation:

- Developing GLP-1-friendly foods high in protein and essential nutrients.

- Creating portion-controlled options that support satiety.

- Reformulation:

- Reducing sugar, carbohydrates, and calories in existing products.

- Focusing on nutrient-dense ingredients to align with new dietary preferences.

- New Product Lines:

- Nestlé launched Vital Pursuit, a frozen food brand specifically targeting GLP-1 users.

- Conagra introduced a GLP-1-friendly label on 26 Healthy Choice frozen meals.

- Marketing Strategies:

- Using clear, transparent labeling to highlight benefits without overwhelming shoppers.

- Emphasizing high-protein and fiber-rich claims.

- Focusing on how products support appetite control and weight management.

- Packaging Innovations:

- Introducing smaller, premium-priced packages to maintain profitability despite reduced consumption.

- Cross-Sector Collaboration:

- Partnering with beauty, wellness, and pharmaceutical industries to offer comprehensive solutions.

Emerging Opportunities

The GLP-1 trend is creating new opportunities for CPG companies:

- Companion Products: Developing foods and supplements that complement GLP-1 medications.

- Nutrient-Dense Options: Creating products that help users meet nutritional needs with smaller portions.

- Functional Foods: Incorporating ingredients that naturally boost GLP-1 levels, such as prebiotic fibers.

- Personalized Nutrition: Offering tailored product lines that cater to specific dietary needs of GLP-1 users.

Challenges and Considerations

While adapting to the GLP-1 trend, CPG companies face several challenges:

- Balancing Taste and Nutrition: Developing products that are both healthy and appealing to consumers.

- Price Sensitivity: Addressing concerns about the higher cost of GLP-1-friendly foods.

- Long-Term Impact: Understanding how consumer behavior may evolve as users adjust to GLP-1 medications over time.

- Market Segmentation: Catering to both GLP-1 users and non-users without alienating either group.

Future Outlook

The GLP-1 trend is expected to continue growing, with the market projected to reach $150 billion by 203010. As more consumers adopt these medications, CPG companies will need to remain agile, continuously innovating and adapting their product portfolios to meet evolving dietary preferences and nutritional needs.

In conclusion, the GLP-1 revolution is fundamentally altering the CPG food landscape. Companies that can successfully navigate this shift by offering tailored, nutrient-dense, and portion-controlled options are likely to thrive in this new market reality. As the trend evolves, collaboration between food manufacturers, retailers, and healthcare providers will be crucial in developing holistic solutions that support consumers' health and weight management goals.

Featured Blogs

TRENDS 2024: Decoding India’s Zeitgeist: Key Themes, Implications & Future Outlook

How to better quantify attention in TV and Print in India

AI in media agencies: Transforming data into actionable insights for strategic growth

How the Attention Recession Is Changing Marketing

The New Luxury Why Consumers Now Value Scarcity Over Status

The Psychology Behind Buy Now Pay later

The Rise of Dark Social and Its Impact on Marketing Measurement

The Role of Dark Patterns in Digital Marketing and Ethical Concerns

The Future of Retail Media Networks and What Marketers Should Know

Recent Blogs

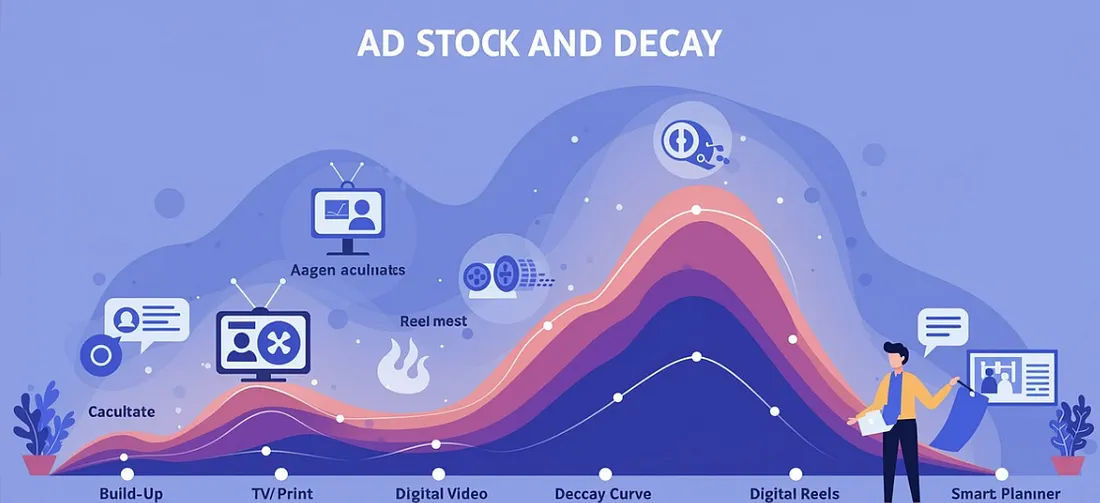

Ad Stock & Decay: The Invisible Hand Guiding Media Schedules

The Big Mac Illusion:What a Burger Tells Us About Global Economics

When Search Starts Thinking How AI Is Rewriting the Discovery Journey

CEP Tracker The Modern Brand Health Metric

Cracking Growth: How to Leverage Category Entry Points (CEPs) for Brand Advantage