Ad Copy GRPs – An Industry Perspective

Executive Summary:

I recently came across some intriguing numbers shared by a friend that sparked my curiosity. I decided to delve deeper into them, unraveling a story that unfolded over the last 32 months. I analyzed the Gross Rating Points (GRPs) expended by ad copies for India's leading 750 brands. My focus was on completed campaigns to establish benchmarks and identify trends in advertising intensity by copy across various categories. Went deep into Four categories : Toilet Soaps, Detergents, Shampoos, and Chocolates.

What I found was a median GRP of 1630 deployed per ad copy across brands. As I pieced together the patterns and trends, it became a compelling narrative on GRPs per ad copy deployment and points to ponder.

Importance of the Quantum of Ad Copy GRPs

Advertising is instrumental in shaping consumer perceptions and driving business success, with substantial marketing budgets devoted to showcasing ad copies to consumers. Determining the appropriate quantum of Gross Rating Points (GRPs) for an ad copy is essential for maximizing business impact. An optimal GRP allocation behind an ad copy ensures that its potential to drive business is fully realized. By mastering the quantum of GRPs, advertisers can optimize their marketing expenditures, ensuring that ad copies attain the ideal level of exposure to achieve significant business outcomes.

Objective of the Article

This article aims to explore the current state of GRPs allocated to ad copies in India, given the importance of determining the right quantum for maximizing business impact. By examining actual GRP allocations to ad copies across various categories, I provide a factual depiction of current practices without offering specific advice due to a lack of comprehensive background on the business outcomes generated. My goal is to present an informative overview that spurs marketing teams to further investigate and analyze GRP support needed for their specific categories. While we refrain from direct recommendations, we conclude with thought-provoking insights for consideration.

1. Methodology and Scope

1.1 Data

Data I got represented the advertising efforts of the top 750 brands in India. Tactical ads specific to events/special days were excluded from this study, focusing on brand-level campaigns with consistent GRP patterns. Market was Northwest with TG AA 15+ NCCS ABCDE.

1.2 Time Frame

The analysis spans the recent 32 months till Jan 2025, allowing for a detailed examination of trends.

1.3 GRP Metrics: Median and Peak

The analysis includes both median and peak GRP values to provide a comprehensive view of advertising intensity. Median GRPs offer insights into typical advertising levels, while peak values highlight the maximum efforts exerted by brands for select ad copies.

1.4 Category Selection

4 categories were selected —Toilet Soaps, Detergents, Shampoos, and Chocolates—for a deep dive.

2. Overall Landscape: 750 Brand Analysis

The first phase of the study focused on understanding the frequency and GRP distribution of ads across GRP bands for India’s top 750 brands. A histogram was used to map out the count of ads within specific GRP ranges.

2.1 GRP Distribution Overview

The Median GRP is 1630 GRPs across ad copies. The distribution shows a concentration in the 1,000–1,250 GRP range, which has the highest frequency (206 ad copies), followed by ranges of 600–700 GRPs and 1,500–2,000 GRPs (166 ad copies each). Fewer ad copies operate in the higher ranges (5,000–10,000 GRP: 107 ad copies; 10,000–25,000 GRP: 26 ad copies).

Frequency of Ad Copies BY GRP range

Key finding is that the median GRP across ad copies is 1630.

3. Category Deep Dives

The GRP distribution across categories shows that Toilet Soaps have a median AD Copy GRP of 3107 and a Top AD Copy median GRP of 4843. Washing Powders/Liquids have a median AD Copy GRP of 2493 and a Top AD Copy median GRP of 6072. Shampoos report a median AD Copy GRP of 2625 and a Top AD Copy median GRP of 3619, while Chocolates have a median AD Copy GRP of 2029 and a Top AD Copy median GRP of 3820.

3.1 Toilet Soaps

- Median GRP: 3,107

- Highest GRPs for ad copies: Two Brands has GRPs per copy of 16000 and 20500.

3.2 Detergents

- Median GRP: 2,493

- Highest GRPs for ad copies: One of the lead brands expended 24100 GRPs behind one copy

3.3 Shampoos

- Median GRP: 2,625

- Highest GRPs for ad copies: One of the lead brands expended 20200 GRPs behind one copy

3.4 Chocolates

- Median GRP: 2,029

- Highest GRPs for ad copies: One of the lead brands expended 8000 GRPs behind one copy

4. Point to Ponder

A lot of ad copies are getting pulled out after 600-900 GRPs (~ Rs 5-7 Cr of Investment). Factoring in the cost of production, it may not be too prudent from an ROI perspective. Wear in happens after 500-600 GRPs and if copies are pulled out just after wear in, we are not giving room for the copy to be milked enough on air. After the wear in GRPs, as long as the brand is not a niche brand, copies should run for at least a multiple of 6X of the wear in level, especially if the link score or equivalent is good.

Featured Blogs

TRENDS 2024: Decoding India’s Zeitgeist: Key Themes, Implications & Future Outlook

How to better quantify attention in TV and Print in India

AI in media agencies: Transforming data into actionable insights for strategic growth

How the Attention Recession Is Changing Marketing

The New Luxury Why Consumers Now Value Scarcity Over Status

The Psychology Behind Buy Now Pay later

The Rise of Dark Social and Its Impact on Marketing Measurement

The Role of Dark Patterns in Digital Marketing and Ethical Concerns

The Future of Retail Media Networks and What Marketers Should Know

Recent Blogs

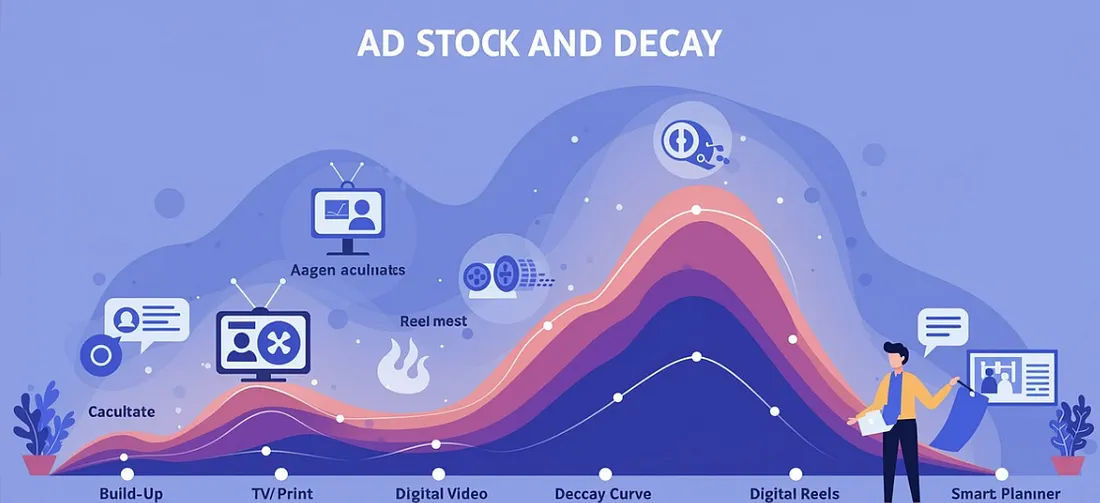

Ad Stock & Decay: The Invisible Hand Guiding Media Schedules

The Big Mac Illusion:What a Burger Tells Us About Global Economics

When Search Starts Thinking How AI Is Rewriting the Discovery Journey

CEP Tracker The Modern Brand Health Metric

Cracking Growth: How to Leverage Category Entry Points (CEPs) for Brand Advantage